RESEARCH

Monetary Policy Surprises and the Term Structure of Equity Yields

Job Market Paper

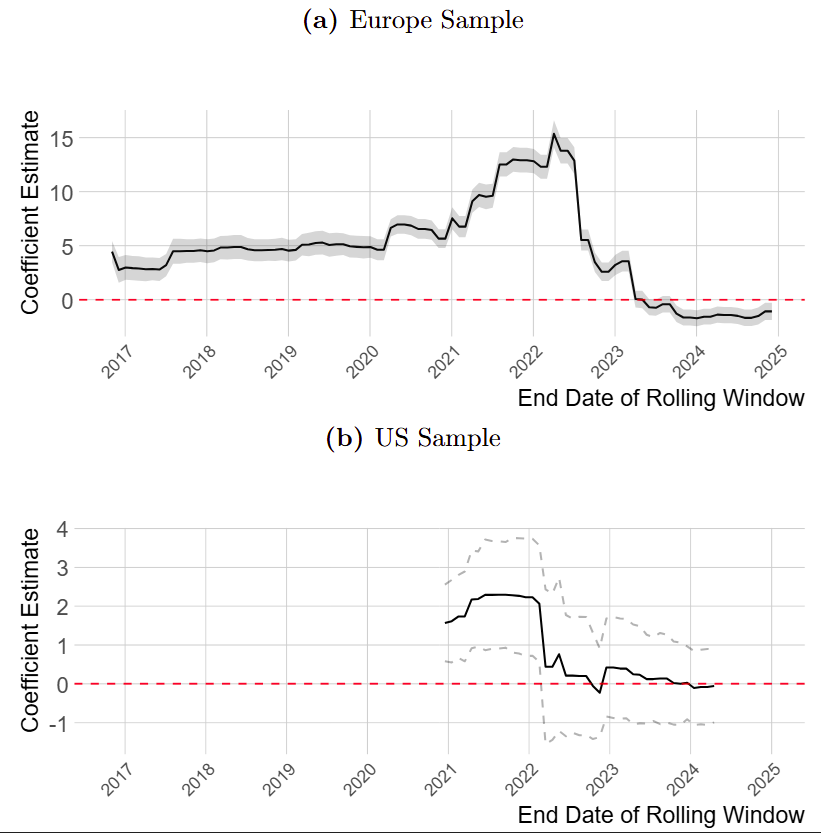

Monetary Policy’s Impact Beyond Risk-Free Rate Exhibits Significant Time Variation.

Abstract: This paper provides a new perspective on monetary policy transmission through financial markets. To do that, I analyze the impact of monetary policy surprises on the term structure of equity, using data from dividend futures markets to directly measure changes in maturity-specific risk premia and expected dividend growth. I find that monetary policy affects asset prices beyond its direct impact on risk-free rates: a 25-basis point surprise change in risk-free rates leads to a 25–50 basis point shift in equity risk premia and expected dividend growth. Notably, this impact is time-varying and significantly stronger in low-interest-rate environments, which is consistent with reach-for-yield behavior by investors. To identify the specific channels through which policy operates, I use a novel method to extract multiple, economically interpretable factors from asset price responses to policy announcements. The findings show that the documented effects on risk premia and expected dividend growth are driven specifically by the component of monetary policy surprises that moves short-term risk-free rates, rather than by components affecting long-term rates or investor risk sentiment.

Presentations (and poster sessions*): SFI PhD Workshop (September 2024), University of Zurich (November 2024), Tri-City Bridge PhD Workshop 2025 (April 2025), Swiss Society for Financial Market Research Conference - SGF (April 2025*), University of Lausanne PhD Macro Workshop (May 2025), University of Zurich (June 2024), SFI Research days (June 2025), HEC PARIS Finance PhD Workshop (August 2025), University of Zurich PhD Macro Workshop (October 2025)

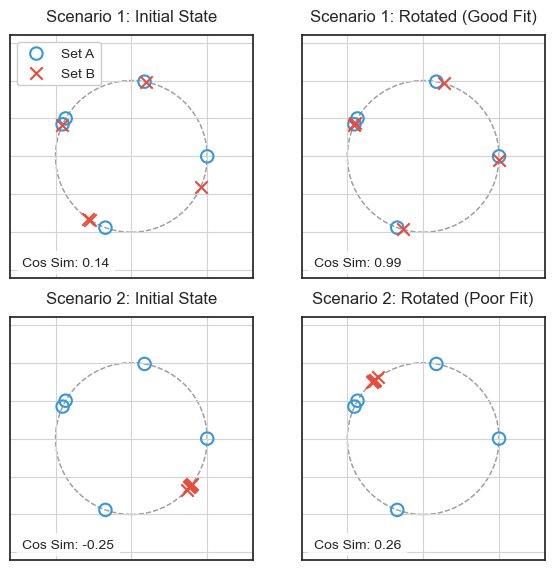

On Finding the Optimal Rotation of Principal Components for Structural Interpretation

Obtaining Optimal Rotation via Singular Value Decomposition.

Abstract: This paper addresses the challenge of interpreting statistical factors derived from principal component analysis (PCA), a common issue in empirical macroeconomics. Traditional methods for rotating these factors to achieve economic meaning are often ad hoc and subjective. The paper proposes a novel approach that systematically finds an interpretable rotation by maximizing the cosine similarity between the statistical factor loadings and a target structure. The maximization problem is shown to be equivalent to the Orthogonal Procrustes Problem, which has a unique, optimal solution provided by Singular Value Decomposition (SVD).

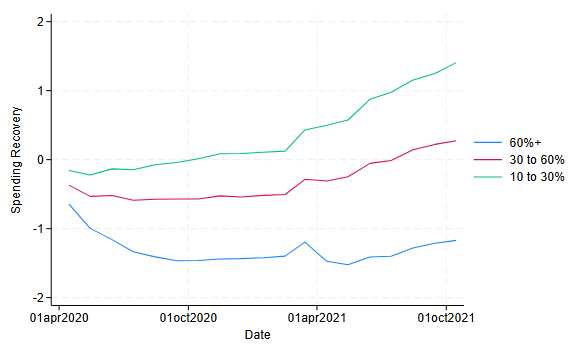

Transitory Shocks and Consumption Dynamics: Pent-Up Demand or Hand-to-Mouth? (with Martin Brown and Jan Toczynski)

Draft available upon request

Evolution of Median Spending Recovery Grouped by Covid Shock Magnitude.

Abstract: We examine the recovery of U.S. consumer spending following the COVID-19 recession using monthly transaction data for over 34,000 individuals. We find no evidence of pent-up demand driven by forced cutbacks on in-person services or curtailed purchases of durables. Instead, spending dynamics are largely consistent with hand-to-mouth behavior: Expenditures during and after the recession are correlated with income changes, especially among households with low liquidity buffers. These results underscore the central role of income and liquidity, rather than sentiment or forced savings, in driving the dynamics of consumer spending.

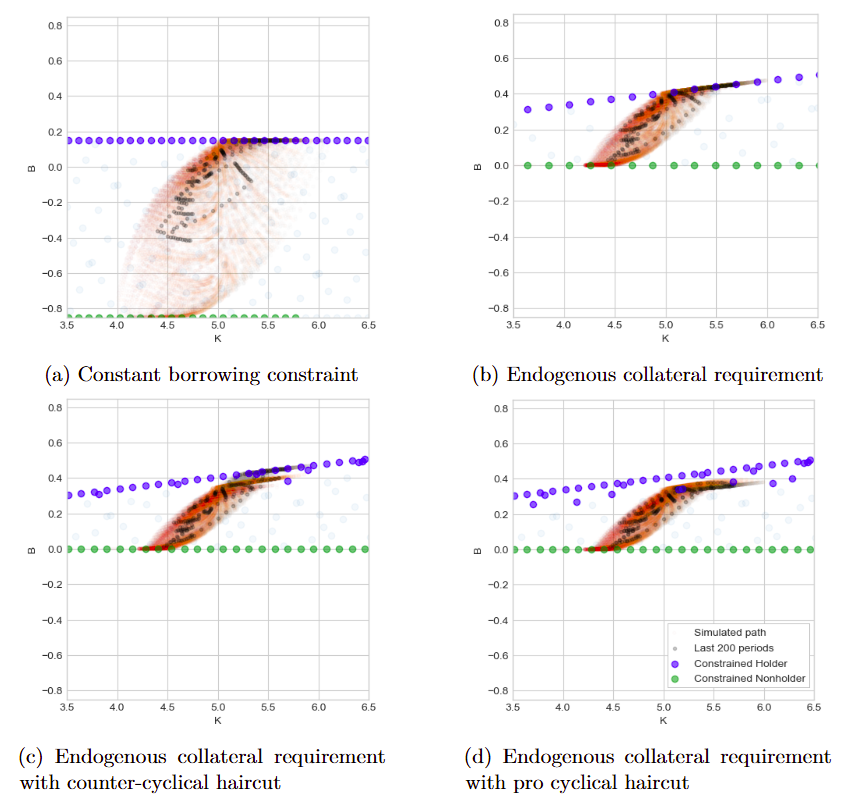

Asset Prices in a GE Model with Endogenous Collateral Requirements and Cyclical Haircuts

Draft available upon request

Cyclical haircut variation has limited effects on aggregates and asset prices outside of crisis dislocations.

Abstract: I study asset prices in the context of a general equilibrium macroeconomic model with production and aggregate shocks. One key innovation of the proposed model is the fully endogenous rational expectations collateral requirements, which ensure a default-free equilibrium. I use this framework to investigate how variations in haircuts throughout different phases of the business cycle affect asset prices. I study both counter-cyclical and pro-cyclical haircut processes and find that both types of haircut processes have very limited effect on both economic aggregates and asset prices.

Presentations and poster sessions: University of Zurich (May, November 2023)